Get European Residency Through Smart, Sustainable Investment

We invest in manufactured innovations for people and the planet.

Live, travel, and grow your wealth in Europe — with only 7 days/year in Portugal.

€500K+

Investment

7 Days

Per Year Required

26 Countries

Visa-Free Access

Invest in Portugal, Invest in Your Future

A Smart Residency Strategy for Global Investors

The Portugal Golden Visa offers a strategic pathway for global investors to gain residency in one of Europe’s most vibrant and forward-looking countries. By investing in Portuguese funds, applicants can support national growth while opening doors to a secure and rewarding future. Below are some of the key benefits of the program:

Fast Track to EU Citizenship

Obtain Portuguese citizenship in just 5 years with minimal stay requirements—only 7 days per year.

Visa-Free European Travel

Enjoy freedom of movement across 26 Schengen countries with your Portuguese residency.

Family Rights

Extend residency to your spouse and dependents, granting them the right to live, work, and study in Portugal.

7th most peaceful country in the world

Free healthcare system and quality education

5th strongest passport

Competitive tax benefits on foreign capital

Secure EU residency through strategic fund investment

The Portugal Golden Visa offers strategic investors a unique pathway to EU residency through regulated fund investments, combining portfolio diversification with access to one of Europe’s most promising markets.

Ready to Secure Your Golden Visa ?

Schedule a personalized consultation with our investment experts to discuss your Portugal Golden Visa journey and explore our fund opportunities.

The Dipalo Heed Advantage

Dual Strategy. Single Pathway.

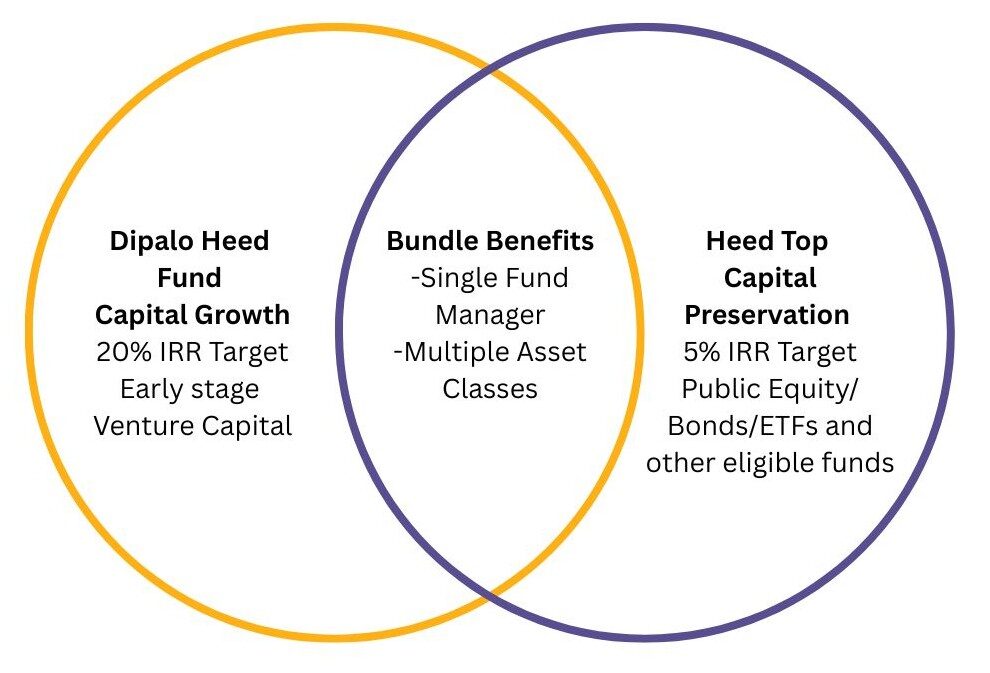

Dipalo Ventures has partnered with Heed Capital to launch two new funds eligible for Portugal’s Golden Visa program. Together, the firms manage approximately €400 million in assets and bring deep experience across U.S. and EU public and private markets.

Where Innovation Meets Stability

Our Dual-Fund Approach

Dipalo Heed Fund II targets high-potential innovations in energy, climate, and advanced manufacturing, while Heed Top offers a conservative mix of public equities and bonds. Together, these funds provide Golden Visa investors with a balanced strategy across risk, return, and investment timelines.

Discover Dipalo Heed Fund:

- The Fund will invest at least 60% of its assets in early stage companies operating in Portugal. 40% will be invested in the US.

- The minimum initial subscription amount is €200,000. Golden Visa applicants must invest at least €500,000.

- Closed-ended fund with 10 year term. No early redemption. Distributions over Fund term based upon exit.

- The expected return is 20% per year, net of fees.

- Non-tax residents in Portugal are tax exempt on both income and capital gains.

The Golden Visa Process

Our streamlined process makes obtaining your Portuguese Golden Visa straightforward and efficient

Let's Build a Global Future Together

Frequently Asked Questions

The process for obtaining a Portugal Golden Visa typically involves the following steps: Choose an Investment Option, Complete the Investment, Gather Documentation, Submit the Application, Biometric Appointment, and Approval and Residency Card Issuance. The process typically takes 6 to 9 months, which can vary depending on the specific circumstances and the chosen investment option.

You’ll need a valid passport, proof of income/assets, police clearance, marriage/birth certificates (for dependents), and civil registry docs for dependents (if applicable).

Yes. You can include your spouse, dependent children, and dependent parents in your application. Your children qualify if they are 24 years old or younger. If they are older but have some special needs, they may be eligible, provided they can demonstrate a student certificate, are single (i.e., unmarried), and are financially dependent.

You must spend a total of 35 days in Portugal over the 5-year Golden Visa period: 7 days in the first year, 14 days across years 2 and 3, and another 14 days across years 4 and 5.

If you apply before any rule change is enacted, your application will be processed under the current rules.

Yes, depending on your investment type, you can earn returns. If you invest in a qualifying fund, the returns would depend on that fund’s performance. It’s essential to carefully evaluate the potential returns and risks of any investment option.